Connect acquisition intelligence to portfolio performance

Connect acquisition intelligence to portfolio performance

Intelligence that flows from deal to asset, revealing opportunities and preserving context with full traceability

When deal intelligence disappears at closing

Investment teams spend months on due diligence, building detailed underwriting assumptions and market analysis.

But when deals close, that intelligence rarely carries forward.

Assumptions stay buried in spreadsheets. Deal context lives in individual memory. Asset teams inherit properties without the "why" behind acquisition decisions.

The result: opportunities remain hidden, risks surface late, and the firm never validates whether underwriting assumptions held true. Intelligence that took months to build vanishes at the moment it becomes most valuable.

Intelligence that connects acquisition to asset performance

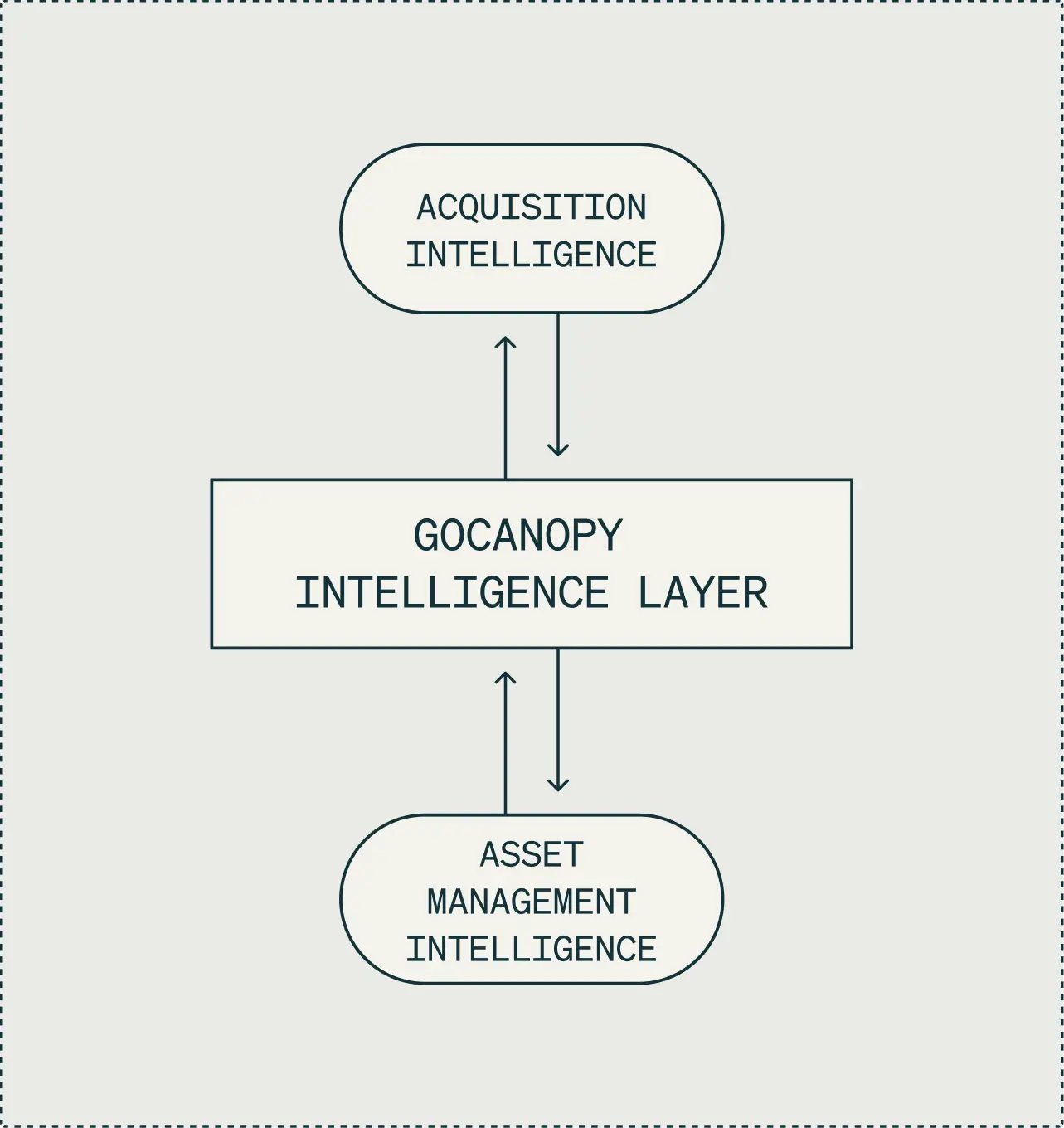

GoCanopy doesn't replace property management systems. It preserves acquisition intelligence and connects it to portfolio performance, ensuring deal context flows forward and institutional knowledge compounds across the lifecycle with complete, organized, and traceable data.

Deal context

that carries forward

Acquisition assumptions, underwriting analyses, and market insights flow directly to asset teams. Every portfolio decision is grounded in the original investment thesis, not incomplete handoffs. Asset managers understand the "why" behind every property from day one.

Hidden value through

connected intelligence

Connect acquisition assumptions to actual portfolio performance, spot discrepancies between underwriting and reality. Uncover opportunities competitors miss by linking deal intelligence to asset-level data. Brookfield uncovered millions in hidden lease value by connecting acquisition terms to portfolio performance.

Hidden Value

Discovery

Analyze how underwriting assumptions perform over time. Identify patterns across portfolio that inform future acquisitions. Every deal strengthens institutional knowledge for both investment and asset teams. Intelligence compounds in both directions.

Value for

investment and asset teams

Results from

institutional investors

Millions

in hidden value uncovered

Brookfield revealed hidden lease value by connecting acquisition assumptions to portfolio performance - opportunities that remained invisible in disconnected systems

"With GoCanopy, I've gained the confidence that we are fully leveraging all the data we receive and generate, and extracting all the insights. Gone are the days of information slipping through the net, ending dormant, or siloed between teams. Instead, we now experience effective cross-pollination of information across investment and asset management teams."

European Head of Logistics and Data Centre Real Estate | Brookfield

Why the bridge matters

Why the bridge matters

Most institutional funds treat acquisition and asset management as separate worlds. Deal tracking tools organize pipelines.

Property systems manage operations. But nothing connects the original investment thesis to portfolio reality.

GoCanopy bridges this gap. Intelligence built during acquisition informs asset decisions.

Portfolio performance validates and improves future underwriting. Institutional knowledge compounds across the full investment lifecycle, not just isolated stages.

Create lasting portfolio value through connected intelligence

Create lasting portfolio value through connected intelligence

See how institutional investors connect acquisition assumptions to performance data, revealing opportunities and ensuring every decision is grounded in traceable insight